The RBA decided to leave rates on hold in April 2017.

Some of the reasons given by the RBA in the statement they released were:

1) banks are increasing interest rates regardless of official RBA decisions and

2) the variable housing market across the country.

When the RBA board releases its monthly interest rate decision, its accompanied by a statement its generally broad and cryptic.

In this blog, I decipher the latest RBA statement and how it impacts you, and the property and finance market.

In the statement, the RBA said:

“Lenders have recently announced increases in mortgage rates, particularly those paid by investors.”

This means banks have increased rates to investors and some owner occupier loans. I think it would have been irresponsible of the RBA to further increase official cash rate. Any additional rate rise could have created some mortgage stress for some borrowers and given more ammunition to the banks to increase interest rates.

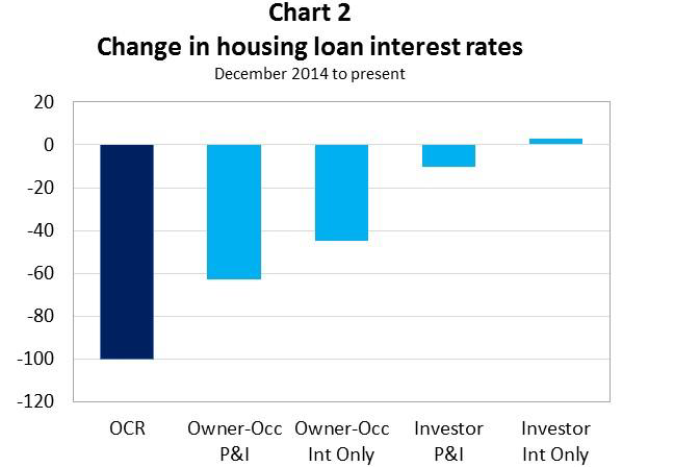

APRA released the chart below, which shows that despite the RBA reducing official cash rates, the banks have not been passing on the savings.

Over the past couple of years, the RBA has cut official rates by 1%, but on average, and I repeat this is “average”, lenders have reduced owner occupier loans by 0.60% and investors by 0.10%. If you are an investor with interest only payments, your rates have become more expensive.

If you are not happy with your current rate, negotiate with your bank. If they do not budge, look around for some options. The big four have the capacity to reduce or renegotiate your rates.

“Financial Institutions remain in a good position to lend.”

This means the banks are doing quite well and have plenty of money to lend. They are trying to calm the market down and tell everyone our banking system is fine.

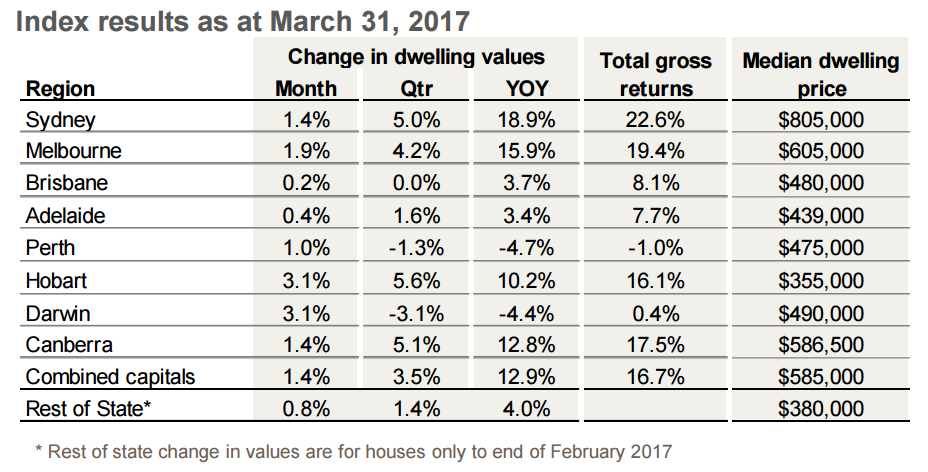

“Conditions in the housing market continue to vary considerably around the country. In some markets, conditions are strong and prices are rising briskly. In other markets, prices are declining”

Sydney and Melbourne property markets continue their strong growth. Hobart and Canberra housing markets are showing great returns in the past 12 months with double digit growth. Brisbane and Adelaide have had some slight growth. Perth and Hobart property markets have been declining the past 12 months.

Table below from Corelogic highlights whats happening across the states.

“In the eastern capital cities, a considerable additional supply of apartments is scheduled to come on stream over the next couple of years.”

RBA is concerned about a potential oversupply of new apartments in the Melbourne and Brisbane property markets. There has been a strong state government push to create jobs and boost construction in these states. RBA is concerned about The concern is once they have been completed in the next 2 – 3 years will there still be a demand for these units and will banks continue to lend. They are stating their concerns now to slow down this over supply issue in the future. State Governments take note!

“Growth in rents is the slowest for two decades.”

No surprise here. With interest rates so low, many investors have not really needed to increase rents. I believe we will see an increase in rents in the coming 12 months as investors will notice that they will need to be contributing more to their investment property loan than they previously did. In short, I expect rents to rise.

“Growth in household borrowing, largely to purchase housing, continues to outpace growth in household income.”

RBA is concerned that wage growth is not keeping up with property growth. They are also concerned about the high levels of debt borrowers are taking on because of the increasing property prices. They want to see a slowdown in property price growth soon or else they will be forced to increase rates or apply stricter lending policies to the banks to curb household debt levels.

“By reinforcing strong lending standards, the recently announced supervisory measures should help address the risks associated with high and rising levels of indebtedness. “

What they are saying here, is that all the changes to interest rates, restricting interest only loans, and trying to slow down investors buying property, should help reduce our household debt exposure.

“Lenders need to ensure that the serviceability metrics that they use are appropriate for current conditions.”

A warning to the banks to increase their serviceability metrics. As the investment rates have increased recently, expect buffers/ serviceability metrics to increase as well. As mentioned in my previous blog, I expect this to increase around the 8% mark, which once again will greatly impact your capacity to borrow.

“A reduced reliance on interest-only housing loans in the Australian market would also be a positive development.”

Over the past year approximately 40% of new loans written where interest only loans. APRA sent a letter to all banks to slow down this down to a maximum of 30% each year. Expect lenders to restrict interest only loans to a max LVR of 80%. In a additions,, banks may also suspend interest only loans all together once they have hit this new 30% cap.

In a nutshell, expect more lending changes and interest rate rises to follow. Investors will continue to be targeted and borrowing will be tighter over the next couple of years. If you haven’t reviewed your loan in a while, now is a great time.

To stay up to date with all things happening in the world of finance and property and how these changes will affect you, subscribe to my blog.

Theo Angelopoulos is mortgage broker with over 15 years of banking and finance experience. Theo is the Director and Founder of The Loans Analyst. A boutique mortgage broking advice firm based in the Sydney CBD that helps clients to buy property, provide strategic loan structuring advice and helping get a great deal on their home loan.